MediPharm Labs Board Issues Letter to Shareholders in Response to Inadequate Dissident Plan

/EIN News/ -- TORONTO, May 28, 2025 (GLOBE NEWSWIRE) -- MediPharm Labs Corp. (TSX: LABS) ("MediPharm" or the "Company"), a pharmaceutical company specialized in precision-based cannabinoids, today issued a Letter to Shareholders from the Company’s Board of Directors (the “Letter”). The Letter is a response to the amended and restated dissident proxy circular filed by Apollo on May 20, 2025, and in particular Apollo’s plan for the Company. The full text of the Letter to Shareholders follows.

MESSAGE FROM THE MEDIPHARM BOARD OF DIRECTORS

Dear Fellow Shareholders,

The Board of Directors of MediPharm Labs Corp. (“MediPharm”, the “Company”, “we”, “our” or “us”), is writing to provide you with important updates on the upcoming vote at our Annual & Special Meeting of Shareholders on June 16, 2025 (the “Meeting”). As a reminder, we encourage you to please vote using ONLY the GREEN proxy or GREEN voting instruction card and support each of the director nominees recommended by MediPharm’s Board of Directors (the “Board”) and the other matters being considered at the Meeting.

Dissident shareholder Apollo Technology Capital Corp. (“Apollo”) has published a plan for MediPharm (the “Dissident Plan”), approximately two weeks after launching their proxy campaign. The Dissident Plan offers little reassurance that Apollo has given serious thought to what they would do if their campaign were successful. In this letter we provide our response to Apollo’s plan, and an update on other important matters relating to the vote.

YOUR COMPANY IS UNDER ATTACK

To begin, it is necessary to state that Apollo’s campaign to seize control of MediPharm is nothing less than an attack against your Company.

We do not believe the dissidents are the well-intentioned and successful business leaders they portray themselves to be. They appear to be a group that descends on companies with sizeable cash balances and other assets that they believe to be vulnerable, parlaying a small and recently obtained ownership position into full control of the board, and then redirecting resources for their own personal benefit at the expense of the other shareholders. We are concerned that they may be misleading shareholders into supporting them while obscuring their true goals. They appear to be counting on shareholder disinterest and low voter turnout allowing their small ownership position to have an outsized influence. Please remember that your support is essential, and every vote matters when the future of the Company is at stake.

Apollo now issues news releases almost daily. While they have expressed concerns about the information we are bringing to light, in reality, we are simply presenting facts from publicly available information that reveal a questionable track record. Informing shareholders about risks is part of the Board’s duty to act in the best interest of the Company.

We believe there are significant risks to MediPharm’s business if this group takes control. The Company is concerned about the prospect of losing customers, suppliers, partners and employees. The consistent feedback we have received from these groups, as well as shareholders, has been very blunt. Many have expressed concerns about their willingness to continue their business relationships with Apollo.

The Chair’s letter to shareholders we distributed on May 11, 2025 (the “May 11 Letter”) recounted the business transformation engineered by CEO David Pidduck and his team since 2022. Today we are better positioned than ever to capitalize on our unique pharmaceutical grade capabilities, growing international business and financial strength. Could Apollo reverse the significant progress MediPharm has made over the past three years?

ANALYSIS OF THE DISSIDENT PLAN FOR MEDIPHARM

Apollo is seeking 100% control of the Board based on its ownership of just 3% of the shares. Among the many standards they must meet to justify a complete replacement of the existing Board is to present a detailed, credible alternative plan for value creation. We believe they have failed to do so. Before getting into their specific strategies, we will offer the following general observations:

- The Dissident Plan is lacking in specifics. Much of it is a plan to make a plan: they will figure out what they will do once they get the keys to the boardroom. This vagueness necessarily forces shareholders to rely on the expertise of the six proposed directors nominated by Apollo (the “Dissident Nominees”).

- In some cases, Apollo is simply adopting our existing strategies where we’ve had success and presenting them as original ideas. At other times, Apollo seeks to halt or reverse strategies that have been essential to our transformation.

- The Dissident Plan suggests that the Dissident Nominees will meet the highest standards in areas like governance, transparency and managerial competence, when their track record demonstrates that to be false.

- The Dissident Plan is silent on a subject put forward as Apollo’s central focus for MediPharm in a proposal for a private placement delivered to the Company by Apollo’s legal counsel on April 11, 2025. That proposal stated: “Apollo will then position MediPharm as a platform for consolidating four profitable private cannabis companies in Canada and Australia.” Dissident Nominees Regan McGee and John Fowler confirmed on a May 26, 2025 podcast (the “Podcast”) that they intend to use MediPharm as a beachhead to roll-up or acquire multiple cannabis companies. Apollo has chosen to conceal its M&A intentions – the single most consequential element of its strategy – from the Company’s shareholders.

- Lastly, and crucially, the Dissident Plan is built upon false premises and misinformation about MediPharm’s business and financial performance. They call for urgent and dramatic solutions to non-existent problems.

Shareholders who received the amended and restated dissident proxy circular dated May 20, 2025 (the “Dissident Circular”) may have noticed that the “plan” included in that document consisted, in its entirety, of five bullet points totaling 46 words. Presumably the full-length Dissident Plan was an afterthought and was not ready by the deadline to print the Dissident Circular. Given the aggressive campaign launched to overthrow the Company’s entire Board, we would have assumed that an informed, thoughtful and well-articulated plan would have been a top priority, as opposed to the questionable behaviour, fearmongering and intimidation tactics used by the dissidents.

In order to keep our shareholders informed, we are incorporating into our analysis the more detailed five-pillar plan Apollo subsequently posted to a website. Commentary on each of the five points follows.

Pursue growth in international markets

Admittedly, targeting the international medical market is the best idea in the entire Dissident Plan; however, that is because it mirrors MediPharm’s existing strategy. Apollo proposes that MediPharm should “unlock growth” and “re-engage” the international market that already forms the largest and fastest-growing segment of our business. This reinforces that Apollo either does not understand our current strategy or is repackaging our initiatives as their own.

The international medical market now represents more than half our revenues, and it grew by 87% year-over-year in Q1 2025. This is part of what Apollo describes as our revenue “imploding.” The biggest single driver of our international growth has been the highly successful VIVO acquisition (which Apollo describes as a “disaster”). We continue to forge new partnerships to accelerate growth in both existing and new markets such as Brazil in a thoughtful and strategic manner.

Something vital to understand about the international medical business is that it requires building long-term, co-operative relationships and trust with customers and partners. A key European customer has already advised us that they would cease doing business with MediPharm if Apollo is successful in taking control. Apollo’s approach of threats, misrepresentations, baseless claims and distracting, unending litigation is simply incompatible with the pharmaceutical space, where patients’ health and well-being are at stake. Far from growing our international business, Apollo would be more likely to jeopardize the tremendous progress we have made.

Look for ways to reduce expenses

Once again, Apollo takes an aspect of the business in which we have been highly successful and adopts it into their own plan. We agree that financial discipline is essential. MediPharm’s management team has reduced operating expenses by $42 million on an annualized basis in the past several years, compared to the combined MediPharm and VIVO Cannabis operations in the first quarter of 2022, and expect this emphasis on financial discipline to continue in 2025 and beyond.

Effective cost management, along with revenue growth and margin expansion, enabled us to invest in working capital in Q1 2025, building up inventory to address near-term sales opportunities. These investments will drive sales and generate cash, which in turn can help fund further investments in growth. This cash flow cycle is fundamental to any manufacturing business.

The Dissident Circular and other communications materials, however, describe the $3.3 million of cash we used in Q1 2025 as a “loss” and incorrectly claim the Company is “on pace to run out of cash by November 2025.” These statements are false and misleading, based on mischaracterized financial data and an apparent misunderstanding of our working capital cycle, and seemingly intended to create a false sense of panic. As Apollo is well aware, the Company’s actual net loss in Q1 2025 was $387,000, a year-over-year improvement of $3.2 million.

On the basis of fabricated urgency, Apollo plans to “halt all non-essential spending” and “conduct a comprehensive strategic review of expenses and business units to preserve capital.” MediPharm’s Board and management team have already been doing so for the past several years, as evidenced by the improvement in margins and profitability. We have doubts that such a review can be led by Apollo Chairman and CEO Regan McGee, who does not appear ever to have run a profitable business, or by the other Dissident Nominees who lack experience in the medical cannabis and pharmaceutical space. It is noteworthy that Mr. McGee and his associates have never asked us a single question about the business or shown interest in any operational or commercial aspects of the Company.

Stop the sale of assets

Apollo’s plan to “end the reckless sale of productive assets” is in direct contradiction to their commitment to reduce expenses. Operating unprofitable facilities or business units costs money. An important driver of the operating expense reductions noted above has been our strategic refocusing on the core business. That refocusing has included asset sales that will have generated $14 million of cash in the past three years, including the $4.5 million of proceeds from the Hope facility sale we expect to close in June 2025. These non-core asset sales improved our financial position with no sacrifice in strategic value.

Apollo did not identify which asset sales they deemed to be “strategic assets.” This omission speaks to the lack of a coherent strategy – asset preservation cannot be a standalone objective absent a plan to restore profitability. Perhaps they are referring to the Hope facility where we had already ceased commercial activities, or the equipment purchased and built during the pre-2020 era that was not being used. Perhaps they would have retained the Australian facility which was redundant and bleeding cash.

To be clear, our current cash position and operating performance are sufficient to continue to execute on our strategic plan. With virtually no debt and outright ownership of our two remaining production facilities valued at over $15 million, we believe we have access to capital if required. We are under no pressure to sell any assets and would only do so if they no longer fit with our strategy. We will continue to manage our portfolio of assets appropriately.

Replace the CEO and rework the compensation structure

The Dissident Plan is to fire David Pidduck and launch a global search for a new CEO. Apollo has not disclosed who would serve as interim leadership, leaving a critical gap in governance continuity at a pivotal time for the business. This is an important detail that Apollo should have communicated to shareholders, given that it would apparently take effect immediately.

Would the new CEO be Regan McGee, someone in the real estate sector with no cannabis or pharmaceutical experience? Or perhaps it would be Dissident Nominee John Fowler, who was recently relieved of his CEO duties at Muskoka Grown after joining the public attack against its own customer, MediPharm? His active campaigning on behalf of Apollo raises the question of whether he has been promised a reward for his efforts beyond a Board seat. We also note that Mr. Fowler was eased out of the C-suite at Supreme Cannabis well before its sale to Canopy Growth Corporation which Apollo implies was one of Mr. Fowler’s accomplishments. Neither choice seems like a good one. Nor does it appear to be in the best interests of shareholders.

We suspect Mr. McGee would oversee the CEO recruitment process, as he has spearheaded every aspect of the dissident campaign and is the only Dissident Nominee to own any MediPharm shares. It is noteworthy that Mr. McGee has had multiple close business relationships end in litigation. This includes disputes with at least six former directors (which he considers to be a “small group” although it represented 75% of the eight directors who were not Mr. McGee or his wife), two former CFOs and multiple investors in Apollo subsidiary Nobul – even though he appears to have had full control over the selection of those individuals. This raises a number of questions:

(1) Is Mr. McGee a good judge of talent?

(2) Does he select good people who then, allegedly, proceed to go “rogue” and inexplicably conspire against him?

(3) Is he really the visionary and successful leader he claims to be?

Similarly, the litigation, board upheaval and CEO/CFO turnover at Check-Cap seem to follow a similar tumultuous pattern under the leadership of two of Apollo’s other Dissident Nominees, David Lontini and Alan D. Lewis II.

Are these the people you would trust to choose or become MediPharm’s next CEO?

The Dissident Plan places significant emphasis on compensation, promising to “align executive compensation with shareholder returns and profitability.” As noted in the May 11 Letter, the fully independent Compensation Committee of the Board sets ambitious targets, rewards our executives for meeting them, and includes a meaningful equity component so that the financial interests of our officers are well-aligned with those of our shareholders. As a significant shareholder, Mr. Pidduck has a very strong incentive to increase the share price.

Given the number of issues raised and to de-bunk many of the accusations made by Apollo, we have added more detailed insights into executive compensation to our AGM website at www.medipharmlabsagm.com.

MediPharm has undergone a dramatic turnaround under Mr. Pidduck’s leadership since he joined the Company as CEO three years ago at a time the Company was in true financial distress.

The Canadian cannabis sector has been littered with bankruptcies in recent years, in contrast to MediPharm’s consistently improving results and peer-leading balance sheet and cash position. The Board is confident that shareholders have received full value for the compensation we have paid to our executive team over the past few years. The compensation of the CEO has decreased in each of the past two years.

Before moving on from the topic of executive compensation, we will note that we have been very concerned to learn about publicly available allegations made by former directors and shareholders of Nobul that Mr. McGee and his co-defendants “siphon investor funds for themselves and leave only a minimal amount of capital in the company.”

Transparency and good governance

The final plank of the Dissident Plan represents one of the most serious areas of concern. Quite simply, it is our view that this is not the right group of individuals to be making representations of any sort about transparency and governance. Apollo’s slate of Dissident Nominees is rife with corporate governance flaws, including interlocking relationships that would impair independence, potential conflicts of interest, and limited experience in the medical cannabis and pharmaceutical space. We described these problems in our May 15, 2025 news release.

Apollo says its nominees would “serve shareholders, not management.” We were very concerned by the allegations made by the six former directors of Mr. McGee’s Nobul, highlighting a “toxic” atmosphere, “gutted” internal controls, and crucial information being “stonewalled,” “obfuscated” or “actively concealed” from the board and shareholders. Such allegations, if accurate and proven in court, would represent the antithesis of both transparency and good governance. We excerpted some of these allegations in our May 21, 2025 news release.

Three of the Dissident Nominees (Mr. Lontini, Mr. Lewis and Mr. McGee) have been involved in questionable governance practices at Check-Cap, appearing to drain its treasury by transferring millions of dollars of cash to fund Nobul’s business and investor activism pursuits, potentially contrary to the interests of Check-Cap shareholders. We detailed this troubling situation in a May 23, 2025 news release.

The MediPharm Board stands behind our performance on governance practices. Our seven nominees include five independent directors, two of whom are women, with none of the interlocking relationships that would impair the independence of the Dissident Nominees. We pride ourselves in conducting all of our business relationships with integrity, trust and transparency.

A CAMPAIGN OF MISREPRESENTATION

As mentioned several times already, Apollo has chosen to make liberal use of misleading statements, misrepresentations and outright deception in its communications to MediPharm shareholders in an attempt to create a false sense of urgency and doom. The Dissident Plan is largely built on a need to solve imaginary problems. Unlike MediPharm, Apollo is not constrained by securities laws and the rules of the TSX in making misrepresentations to the market, and has certainly been taking advantage of this when making bald assertions in their communications with the public and MediPharm shareholders. Below are just a few of the more egregious examples of Apollo’s recent misrepresentations about MediPharm.

-

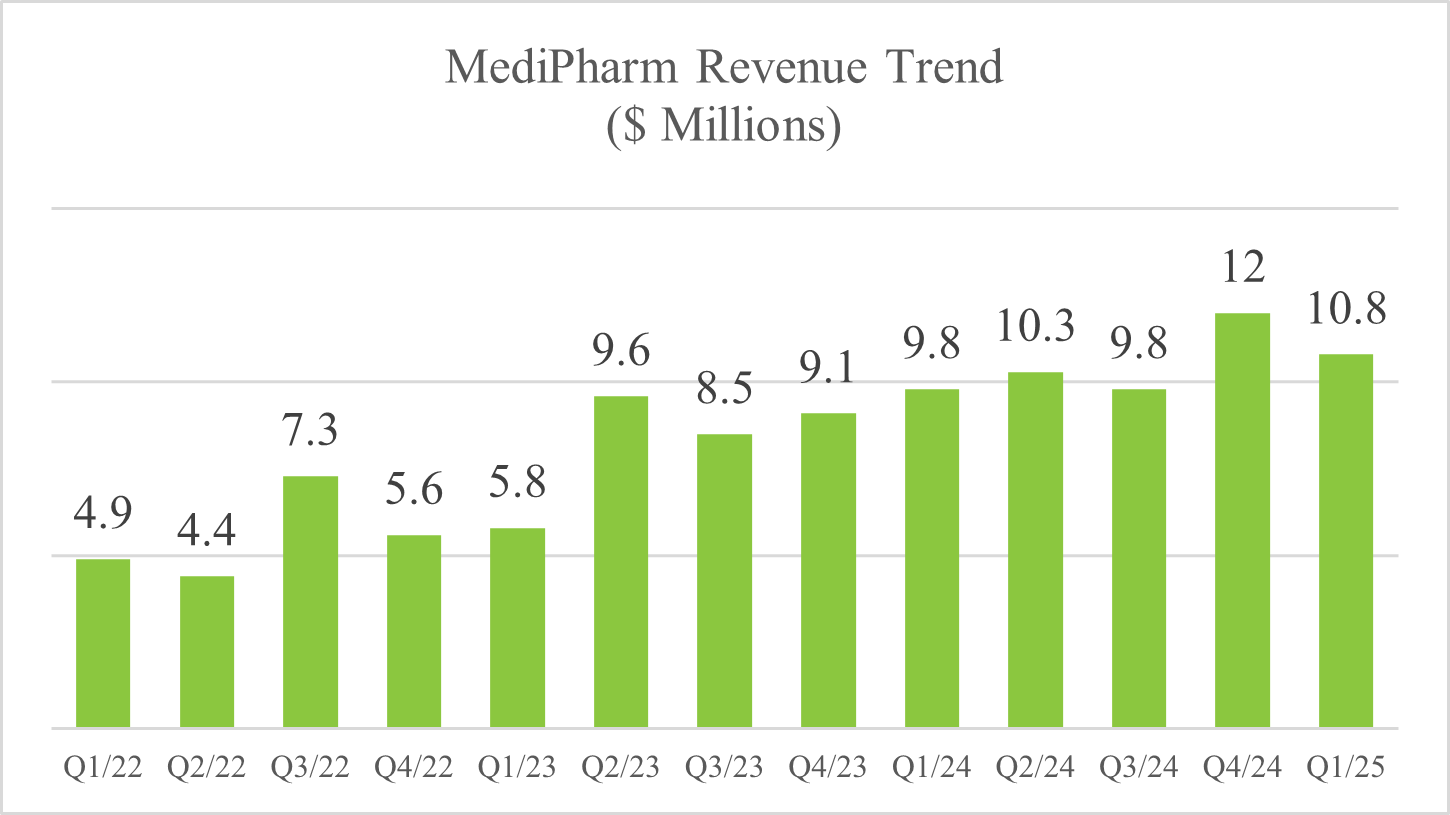

“Revenue is imploding.” We will let shareholders judge whether our quarterly revenue chart over the past three years indicates an implosion.

-

“Disastrous first quarter results.” The Company’s Q1 2025 year-over-year results included a 10% increase in revenue, a 53% increase in gross margin, and the first quarter of positive Adjusted EBITDA1 in over five years.

- “Executive Compensation Has SOARED.” Executive compensation decreased in each of the past two years, as disclosed in our Management Information Circular of May 11, 2025.

- “The Company [has become] over-levered.” MediPharm has virtually no debt.

- “… the Board launched an expensive proxy contest.” This assertion is patently absurd. It was not the Board’s idea to devote resources to a proxy contest against ourselves, but we will fight to protect the interests of our shareholders. In addition, Apollo has stated in its public filings that it intends to seek reimbursement from MediPharm of expenses it has incurred in launching the proxy battle, including up to $250,000 payable to Apollo’s proxy solicitor, up to US$325,000 payable to its communications advisor (inclusive of a success fee), and according to the Podcast, several million dollars payable to Apollo’s legal advisors.

The sheer volume of misinformation leads us to conclude that Apollo is actively trying to harm MediPharm’s business in order to advance their own self-interest and seize control. This behaviour is consistent with the intention articulated in a communication sent to multiple shareholders in April by former MediPharm CEO Pat McCutcheon, who we believe to have been acting on behalf of Apollo. That communication said Apollo’s plan was to:

“go with a very aggressive public markets communications strategy and attack the company legally – which will drop the stock to [$0.01 to $0.02] and then give them the ability to do a hostile takeover of the company.”

_______________________________________________

1 Represents a non-GAAP financial measure, which is not a standardized financial measure under IFRS and which might not be comparable to similar financial measures disclosed by other issuers. MediPharm calculates Adjusted EBITDA as net income (loss) with interest, taxes, depreciation and amortization, non-cash adjustments and other unusual or non-recurring items added back. Refer to the sections entitled “Use of Non-IFRS Financial Measures” and “Reconciliation of Non-IFRS Measures” in MediPharm’s management’s discussion and analysis for the three months ended March 31, 2025, which is incorporated by reference herein and which can be located on MediPharm’s profile on SEDAR+ at www.sedarplus.ca.

Our shareholders should be asking why they would ever trust this group to run the Company.

We also wish to provide an update on certain litigation matters relating to Apollo. On May 23, 2025, Apollo agreed to dismiss its frivolous $50 million conflicts claim against our litigation counsel, in its entirety. As part of the agreement to dismiss the claim, Mr. McGee, ATCC and Nobul also unequivocally declared: “Tyr LLP and James Bunting have not misused confidential information and are not in a conflict of interest by acting for MediPharm.” We believe this development illustrates why scepticism should be applied to any statements made by Apollo, and expect that their equally meritless $50 million defamation suit which remains outstanding against David Pidduck and our Chair, Chris Taves, will also lead nowhere.

In contrast to the Dissident Plan, we invite shareholders to review MediPharm’s proven strategy for creating value in our publicly filed documents including in our AGM website at www.medipharmlabsagm.com, under the heading “Our Plan.”

SHAREHOLDER ENGAGEMENT AND SUPPORT

We hope shareholders would agree that the MediPharm team has always made ourselves available to you and all shareholders. Since the start of this proxy contest, we have increased our outreach to ensure that you have the information you need.

As for Apollo’s claims that the Board has refused to engage with them, that is yet another of their misrepresentations. We touched on Mr. McGee’s threatening behaviour in the May 11 Letter. We regularly speak with a wide range of stakeholders, from customers to suppliers, regulators, other industry players, investors and potential M&A partners. We have never experienced anything close to the hostile approach Mr. McGee has taken. We do not do business with people like him, which is part of the reason we turned down the equity offers he made to the Company and to certain MediPharm directors and officers in April.

Apollo has been very vocal about multiple demands for how the Meeting should be run. Mr. McGee has claimed that there are two possibilities: either Apollo will win the proxy contest, or it will have been stolen from him, in which case he plans to launch another costly battle for control. Apollo’s specific demands around these Meeting processes are unfounded and overreaching in light of the already equitable and protective measures the Company has put in place, in accordance with and in addition to applicable corporate and securities laws, to run a fair and just Meeting. MediPharm is committed to holding orderly annual meetings in compliance with securities and corporate laws and has always upheld shareholder democracy.

We wish to thank many of our long-term shareholders who have been supportive through this process, while asking good questions and offering solid, thoughtful advice. The executive team and Board have been very impressed with the knowledge and passion you have shown for MediPharm’s business. The one thing that could allow a dissident group like this one to take over a company is apathy and disinterest from shareholders. Every vote matters, and we are very happy that so many of you are vested and engaged in the success of the Company.

PLEASE VOTE TO PROTECT YOUR INVESTMENT

As shareholders, you are receiving conflicting information from both sides of this proxy contest. The Board recognizes that it is you as shareholders who decide the future leadership and control of the Company.

Apollo has not presented a serious plan. That, along with their track record, leaves us to conclude that their true objective is to take control of the Company’s cash and assets without offering a premium or credible long-term plan. We urge you to protect your investment and vote the GREEN proxy.

Remember that your vote is important, regardless of the number of shares that you own.

|

TIME IS SHORT – Act Today As a shareholder, protecting the value of your investment in MediPharm is in your hands. Vote FOR the seven incumbent management Directors using ONLY the GREEN proxy. To ensure your GREEN proxy is counted at the Annual & Special Meeting of Shareholders, please submit it well in advance of the Friday, June 13, 2025, at 3:00 P.M. (ET) proxy cut-off. Voting is Simple: Visit the MediPharm website to vote with ease—just enter the GREEN control number located on your GREEN proxy. For your convenience, we have included a duplicate GREEN proxy. If you have already voted using the GREEN proxy, you do not need to vote again. However, if you have previously voted using a dissident proxy, you can change your vote by submitting the attached GREEN proxy. The later dated proxy will be the one counted at the meeting. If you have any questions or require assistance with voting you proxy or voting instruction form, contact MediPharm’s strategic shareholder advisor, Sodali & Co. Toll-free in North America: 1-888-777-2059 Banks, brokers, and international callers: 1-289-695-3075 Email assistance: assistance@investor.sodali.com |

|

Please remember to visit our AGM website at www.medipharmlabsagm.com for the most timely information.

We thank you for your support and look forward to hosting you on June 16, 2025.

Sincerely,

The Board of Directors

MediPharm Labs Corp.

About MediPharm Labs

Founded in 2015, MediPharm Labs specializes in the development and manufacture of purified, pharmaceutical-quality cannabis concentrates, active pharmaceutical ingredients (API) and advanced derivative products utilizing a Good Manufacturing Practices certified facility with ISO standard-built clean rooms. MediPharm Labs has invested in an expert, research driven team, state-of-the-art technology, downstream purification methodologies and purpose-built facilities for delivery of pure, trusted and precision-dosed cannabis products for its customers. MediPharm Labs develops, formulates, processes, packages and distributes cannabis and advanced cannabinoid-based products to domestic and international medical markets.

In 2021, MediPharm Labs received a Pharmaceutical Drug Establishment License from Health Canada, becoming the only company in North America to hold a commercial-scale domestic Good Manufacturing Practices License for the extraction of multiple natural cannabinoids. This GMP license was the first step in the Company’s current foreign drug manufacturing site registration with the US FDA.

In 2023, MediPharm acquired VIVO Cannabis Inc., which expanded MediPharm’s reach to medical patients in Canada via Canna Farms medical ecommerce platform, and in Australia and Germany through Beacon Medical Australia PTY Ltd. and Beacon Medical Germany GMBH. This acquisition also included Harvest Medical Clinics in Canada which provides medical cannabis patients with Physician consultations for medical cannabis education and prescriptions.

The Company carries out its operations in compliance with all applicable laws in the countries in which it operates.

Shareholder Voting Assistance:

If you have any questions or require any assistance in executing your GREEN proxy or voting instruction form, please call Sodali & Co at:

North American Toll-Free Number: 1.888.777.2059

Outside North America, Banks, Brokers and Collect Calls: 1.289.695.3075

Email: assistance@investor.sodali.com

North American Toll-Free Facsimile: 1.877.218.5372

For up-to-date information and assistance in voting please visit: www.medipharmlabsagm.com

Investor Contact:

MediPharm Labs Investor Relations

Telephone: +1 416.913.7425

Email: investors@medipharmlabs.com

Media Contact:

John Vincic

Oakstrom Advisors

+1 (647) 402-6375

john@oakstrom.com

Cautionary Note Regarding Forward-Looking Information:

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate to, among other things: the intent, objectives and implications of the dissidents and the Dissident Plan, the impacts of the actions of the dissidents and the Dissident Plan on shareholders of the Company, amount of voter turnout at the upcoming annual and special meeting of shareholders of the Company scheduled for June 16, 2025 (the “Meeting”), future tactics to be employed by the dissidents, risks to the Company as a result of the actions of the dissidents including any loss of customers, suppliers, partners and employees of the Company, the pursuit of growth by the Company in international markets, forging new partnerships and accelerating growth in existing and new markets, any jeopardization of progress made by the Company, methods for the Company to reduce expenses, any projected liquidity or profitability issues of the Company, any future sales of the Company’s assets, management of the Company’s portfolio of assets moving forward, the future management team of the Company, any changes to executive compensation of the Company, governance practices relating to the Company, any potential takeover of the Company, results of the proxy contest for the Meeting, creation of sustainable long term shareholder value, the Company’s future growth strategies and available M&A opportunities, and the key drivers of the Company’s competitive advantages and international growth objectives. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; the inability of MediPharm Labs to obtain adequate financing; the delay or failure to receive regulatory approvals; and other factors discussed in MediPharm Labs’ continuous disclosure filings, available on the SEDAR+ website at www.sedarplus.ca. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, MediPharm Labs assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0859468b-8cce-40b6-bac1-25bffe659096

Distribution channels: Business & Economy, Healthcare & Pharmaceuticals Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release